BTS – BLOCKCHAIN FINTECH – TRANSFORMING ASSET MANAGEMENT

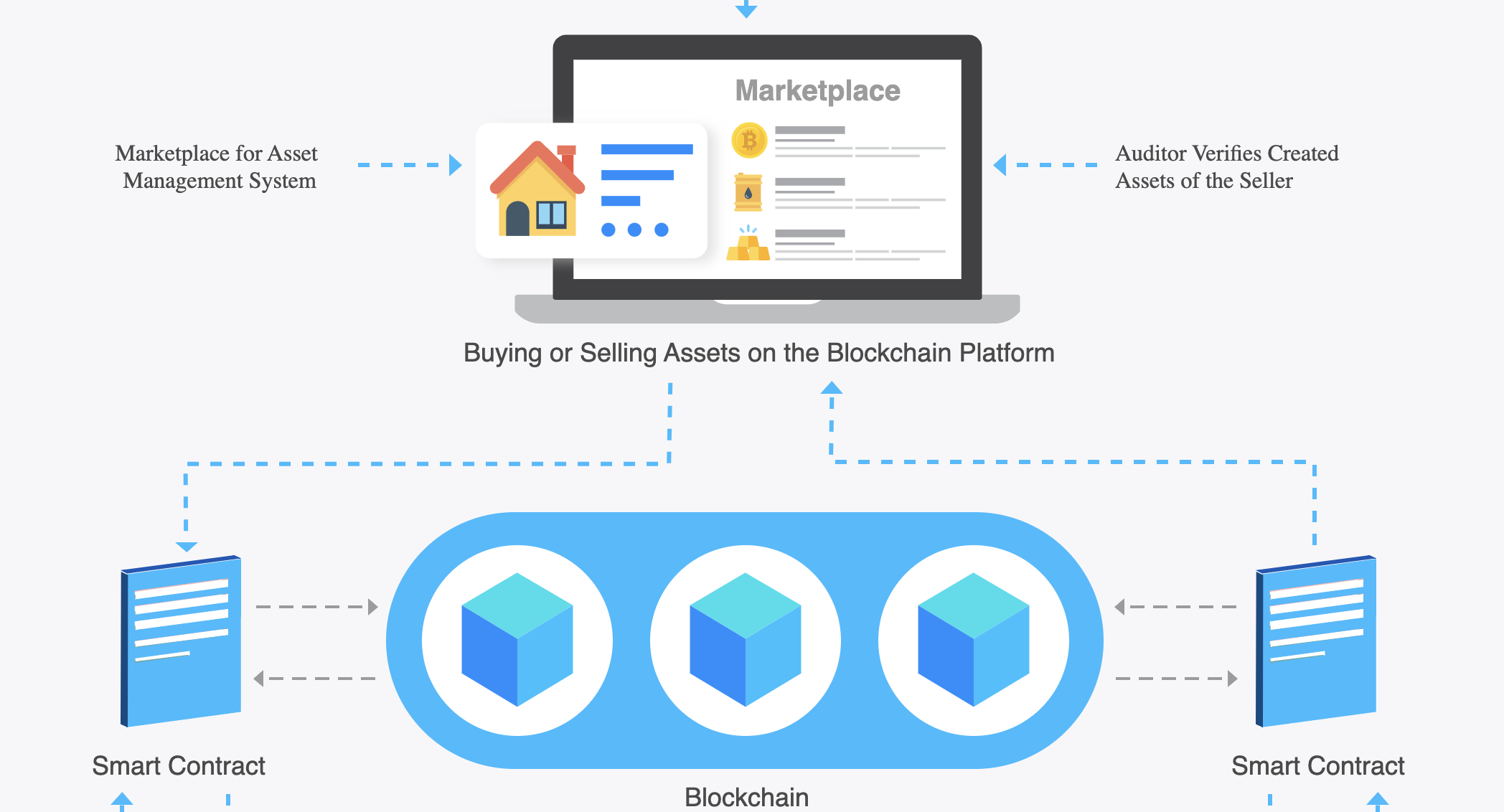

Among the multiple use-cases of blockchain fintech, asset management is also one of the areas where blockchain can reduce approval wait times by automating the complicated processes using smart contracts.

Moreover, it has been found that the asset managers could save around $2.7 billion a year by eliminating the manual practices from the exchange of assets with blockchain.

We will discuss how asset management firms are seeking out the opportunities to adopt blockchain for harnessing its benefits.

Before going in-depth into the blockchain implementation of the asset management, let’s have its preview first.

What is Asset Management?

Asset Management is a process of managing the transfer of an asset from one entity to another. From stocks to bonds, commodities, real estate properties, and private equities, assets can be of various types.

Whether the assets are tangible or intangible, an asset management platform maintains things of value to an entity or group of entities.

The existing asset management process involves a lot of intermediaries like asset managers, custodians, brokers, auditors, and end-investors, adding high costs to the system.

But the current system has certain loopholes due to the lack of transparency and long-tail processes.

An example of the traditional selling and buying of real estate properties

The traditional trade processes within the asset management can be cumbersome and manual due to the involvement of too many mediators.

Each party in the network keeps the copy of the record in their own system. It leads to inefficiencies and delays in settlement of trades.

Let’s consider an example of the existing process of buying and selling of real estate properties.

1. A property seller looks out for the real-estate agency to find the trustful investors.

2. The agency assigns a broker to the seller for managing the real-estate transactions.

3. A broker acts as an intermediary and helps the seller in finding out the right investor.

4. A broker is also responsible for performing due diligence check of both a seller as well as a buyer to ensure if they are investing with the right people or not.

5. Before a buyer buys the property, it has to pass through the clearing-house which facilitates the exchange of payments, transactions or securities.

6. After the clearing-house performs its function, the property is handed over to the buyer.

Similarly, a buyer can approach the seller via the real-estate agents and brokers. The manual process is not only a time-taking process but is it expensive too.

Here are some of the challenges in the traditional asset management process

- Transfer information split among different systems

Currently, everyone uses different systems to store the information related to the transfer of assets in multiple databases. It can result in conflicting data repository schemas, data synchronization problems, and reliability issues. From sellers to real-estate agents, brokers, clearing houses and buyers, everyone maintains their own database. - No traceability

As of now, it is impossible for anyone to have a clear view of all transactional updates. Every update has to go through different stakeholders for approval in the system.Also, a user may have to go through the old paper-based files or data stored on the cloud to know the history of transactions which is quite time-consuming.If any transaction issue confronts at the time of selling or buying of real estate properties, there’s no way to figure out when and where did the problem occur. - The complicated and long-tail onboarding process

A user has to undergo a long-tail verification process before buying or selling assets. It might take several weeks and in some cases, even months to approve if a person is liable to the exchange of assets or not.Verifying the background of sellers or buyers manually may take a lot of time as there is no trust factor which can enable trust on the individual.

Blockchain could overcome the above challenges and transform the end-to-end asset management process by distributing immutable records of information across multiple nodes.

Blockchain Fintech – Innovating Asset Management

We shall first discuss the users who could be involved in the blockchain implementation of the asset management platform and what could be their possible roles.

Implement financial expertise with innovative technologies.

BTS Digital Solution – Fintech Software Development Company

User-personas involved in the asset management platform built on the blockchain

- An admin who controls the onboarding of users to the platform

- A Seller who wants to sell their assets on the blockchain

- A Buyer who wants to invest in the assets by buying them

- An Auditor who can track every activity but cannot update any information

Once the possible stakeholders of the platform are identified, we will discuss what could be the technical components of asset management platform backed by the blockchain.